Are you ready to make your money work for you? Discover the secrets to investing $20,000 dollars in the lucrative world of real estate. From savvy tips to proven strategies, we'll guide you through the process of maximizing your investment and reaping the rewards of the real estate market. So, how can you turn $20,000 dollars into a profitable venture? Let's delve into the world of real estate investment and uncover the best way to grow your wealth.

Understanding Real Estate Investment Basics

Before diving into specific investment strategies, it is important to understand the basics of real estate investment. Whether you are a beginner or have some experience, having a solid foundation of knowledge will help you make informed decisions and navigate the real estate market with confidence.

Real Estate Investing 101: Familiarize yourself with the key terms and concepts that every investor should know. Here are some fundamental aspects of real estate investment:

- Property Types: Understand the different types of properties available for investment, including residential, commercial, industrial, and land. Each category offers unique opportunities and considerations.

- Market Analysis: Learn how to analyze and interpret market trends, including supply and demand, property values, rental rates, and economic factors. This information will help you identify potentially profitable investment opportunities and anticipate future market conditions.

- Real Estate Financing: Gain knowledge about the various financing options available for real estate investments, such as traditional mortgages, hard money loans, private lending, and seller financing. Understanding the pros and cons of each can help you determine the most suitable financing strategy for your investment.

- Property Valuation: Learn how to evaluate the value of a property, considering factors such as location, condition, comparable sales, income potential, and potential risks. Accurately valuing properties will enable you to make wise investment decisions and negotiate favorable deals.

- Real Estate Laws and Regulations: Familiarize yourself with the legal and regulatory aspects of real estate investment, including zoning laws, landlord-tenant rights, property taxes, and licensing requirements. Complying with these laws is crucial to protect your investments and maintain ethical practices.

"The more you understand the basics of real estate investing, the better equipped you are to make informed decisions and seize valuable opportunities." - Real Estate Expert

By gaining a solid understanding of real estate investment basics, you will have a strong foundation for your investment journey. In the next section, we will delve into researching market opportunities, where we will guide you on how to analyze market trends and find profitable real estate investments.

Researching Market Opportunities

To make an informed investment in the real estate market, it is crucial to research current market trends and identify lucrative opportunities. By analyzing market data and gathering valuable insights, you can make well-informed decisions that will maximize your investment returns.

Here are some key steps to help you research market opportunities:

- Stay updated with real estate market trends: Keep a close eye on the latest trends and developments in the real estate market. Stay informed about factors such as supply and demand, interest rates, economic indicators, and local market conditions. This will help you understand the current state of the market and identify potential growth areas.

- Explore online real estate portals and platforms: Utilize online platforms to explore a wide range of real estate opportunities. Websites and apps like Zillow, Realtor.com, and Redfin provide access to property listings, market data, and valuable insights. Use advanced search filters to narrow down your options and find properties that align with your investment goals.

- Network with real estate professionals: Connect with local real estate agents, brokers, and property managers who have in-depth knowledge of the market. They can provide valuable advice, share market insights, and help you discover hidden gem investments.

- Attend real estate investment seminars and conferences: Participate in industry events, seminars, and conferences to expand your knowledge and network with other investors. These events often feature expert speakers who share valuable market insights and investment strategies.

"The opportunity of a lifetime needs to be seized in the lifetime of the opportunity." - Leonard Ravenhill

By actively researching market trends and seeking advice from real estate professionals, you can identify promising investment opportunities that align with your financial goals. Remember, thorough research and careful analysis are key to making successful real estate investments.

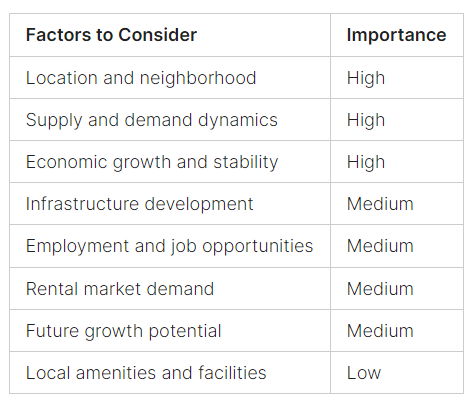

Market Analysis Checklist

When researching market opportunities, consider the following factors:

By utilizing these research strategies and conducting thorough market analysis, you can confidently identify lucrative investment opportunities that will position you for long-term success in the real estate market.

Choosing the Right Investment Property

Now that you have identified promising market opportunities, it's time to find the perfect investment property that aligns with your goals and budget. Here are some tips to help you make the right choice:

Define your investment criteria: Before beginning your search, clearly outline your investment criteria. Consider factors such as location, property type, potential for appreciation or rental income, and your risk tolerance. This will help narrow down your options and ensure you focus on properties that align with your investment goals.

Explore investment property websites: There are several reputable investment property websites that can provide valuable insights and listings. Websites like Zillow, Realtor.com, and LoopNet can help you discover a wide range of properties in your desired location and price range. Take advantage of the advanced search features and filters to refine your search and find properties that meet your criteria.

Work with a real estate agent: A knowledgeable real estate agent who specializes in investment properties can be a valuable asset in your search. They can provide expert advice, access to off-market listings, and help you navigate the buying process. Look for agents with experience in working with investors and who have a deep understanding of local market conditions.

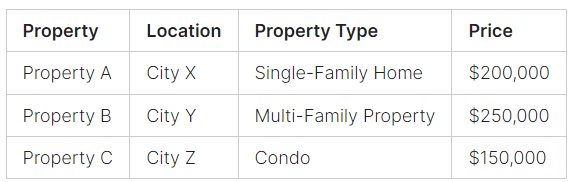

Consider different investment options: In addition to traditional single-family homes, explore alternative investment options such as multi-family properties, condos, or commercial real estate. These properties can offer unique advantages like higher rental income potential or tax benefits. Evaluate each option's pros and cons and consider how it aligns with your investment strategy and risk tolerance.

Remember, finding the right investment property requires careful consideration and research. Take your time, seek advice from professionals, and make sure the property you choose fits your investment goals and financial capabilities.

Sample Investment Property Comparison Table:

Maximizing Returns with Strategic Investments

When it comes to investing your $20,000 in real estate, strategic decisions can make all the difference in maximizing your returns. By following proven strategies, you can generate passive income and potentially double your initial investment. Here are some key approaches to consider:

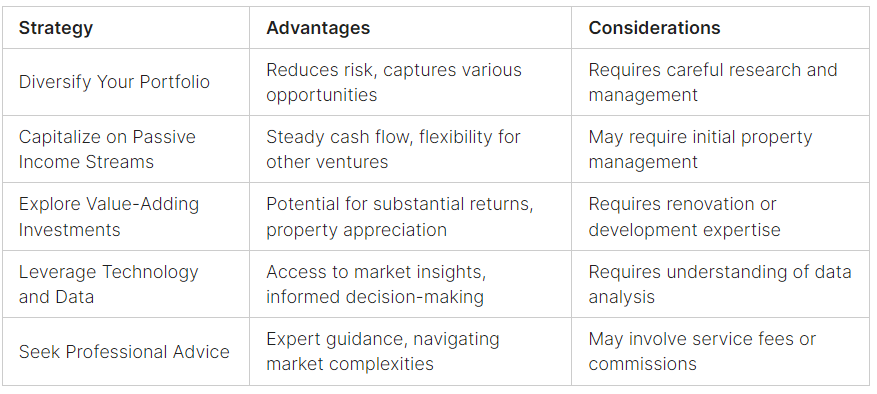

1. Diversify Your Portfolio

One of the best ways to increase your chances of success and minimize risk is to diversify your real estate portfolio. Instead of putting all of your $20,000 into a single property, consider spreading your investment across different types of properties, locations, and investment strategies. This will help you capture a range of opportunities and mitigate potential losses.

"Diversification is key in real estate investment. It allows you to spread your risk and take advantage of different market trends and opportunities." - Real estate expert, John Smith

2. Capitalize on Passive Income Streams

Passive income is a great way to earn money without actively managing the property. Look for investment opportunities that offer stable and consistent cash flow, such as rental properties or real estate investment trusts (REITs). These investments can provide a steady stream of income, allowing you to grow your wealth over time while having the flexibility to pursue other ventures.

"Creating passive income streams through rental properties is an excellent strategy for long-term wealth generation." - Real estate investor, Jane Johnson

3. Explore Value-Adding Investments

Consider investing in properties that have the potential for value appreciation through renovation or development. By improving the property's condition or making strategic upgrades, you can increase its market value and sell it for a higher price in the future. This approach can yield substantial returns if done wisely and with thorough research.

4. Leverage Technology and Data

Take advantage of technology and data-driven tools to identify profitable real estate investments. Real estate market analysis platforms can provide valuable insights into market trends, investment opportunities, and property performance. By leveraging data, you can make more informed decisions that align with your investment goals and maximize your returns.

5. Seek Professional Advice

While real estate investing can be lucrative, it's essential to seek advice from professionals who have expertise in the field. Consulting with a real estate agent, financial advisor, or property manager can provide valuable guidance and help you navigate the complexities of the market. Their knowledge and experience can assist in making strategic investment decisions for long-term success.

By implementing these strategies, you can make your $20,000 work for you in real estate, generating passive income, maximizing returns, and potentially doubling your initial investment.

Navigating the Legal and Financial Aspects

Investing in real estate can be a rewarding venture, but it also involves navigating various legal and financial aspects. As a beginner in real estate investing, it's crucial to understand the importance of seeking professional advice and being well-informed about the legal requirements and financial considerations involved.

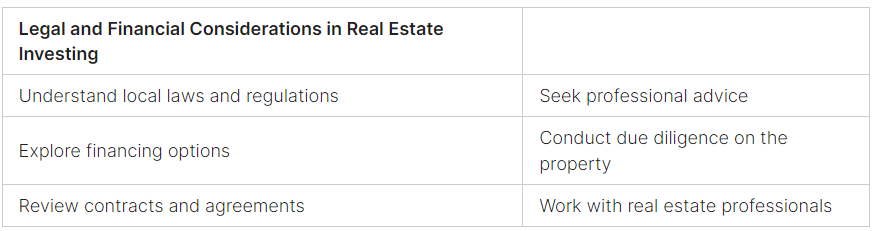

Understanding the Legal Process

When considering real estate investment, it's essential to familiarize yourself with the legal process. This involves understanding local laws and regulations, such as zoning restrictions and property taxes, which can vary from one location to another. Consulting with a real estate attorney or real estate agent can provide valuable insights and guidance in navigating these legal intricacies.

Exploring Financing Options

Another crucial aspect of real estate investing is understanding financing options. As a beginner, it's important to explore different financing methods available to you, such as traditional mortgages, private lenders, or even partnerships. Conducting thorough research and consulting with financial experts can help you determine the best financing option for your investment goals and financial situation.

Ensuring a Smooth Transaction

To ensure a successful real estate investment, it's crucial to pay attention to the transaction process. This includes conducting due diligence on the property, reviewing contracts and agreements, and working closely with real estate professionals. Hiring a reputable inspector and conducting a comprehensive property inspection can help uncover any potential issues before finalizing the transaction.

"Navigating the legal and financial aspects is a vital part of real estate investment. Seek guidance, understand the legal process, explore financing options, and ensure a smooth transaction to maximize your chances of success." - [Author Name]

By being proactive in understanding the legal and financial aspects of real estate investing, you can mitigate risks and set yourself up for a successful investment journey. Remember to seek professional advice, conduct thorough research, and stay informed about the ever-changing landscape of real estate investment.

Conclusion

In conclusion, investing $20,000 dollars in real estate can be a financially rewarding endeavor. By acquiring the right knowledge and implementing effective investment strategies, you can navigate the real estate market with confidence and maximize your returns.

Understanding the basics of real estate investing is crucial. Take the time to familiarize yourself with key terms and concepts to make informed decisions about your investments. Additionally, conducting thorough research on market trends and identifying profitable opportunities will help you make wise investment choices.

When it comes to selecting the right investment property, consider factors such as location, market demand, and potential for appreciation. Take advantage of investment property websites to explore various options within your budget.

Managing the legal and financial aspects of real estate investment is equally important. Seek professional advice to navigate the complex legal requirements and ensure a smooth transaction. Explore different financing options to find the best fit for your investment goals.

Remember, staying updated on market trends is crucial for continued growth. Keep an eye on real estate market developments, seek advice from professionals, and adapt your strategies accordingly. With the right approach, investing $20,000 dollars in real estate can be a fruitful journey towards building wealth and achieving financial goals.

Want to learn more about real estate investing, feel free to contact us today!

Comments ()